philadelphia property tax lookup|philadelphia brt property search : Baguio Get information about property ownership, value, and physical characteristics.

©2023 Edgewater Hotel, Casino & Resort 2020 S. Casino Drive | Laughlin, Nevada 89029 Phone: 702.298.2453 • Toll Free Reservations: 800.677.4837 Gift Cards Contact Us

PH0 · property owner tax records

PH1 · philadelphia property records

PH2 · philadelphia property assessment

PH3 · philadelphia brt property search

PH4 · opa philadelphia property search

PH5 · city of philadelphia real estate taxes

PH6 · board of revision of taxes philadelphia

PH7 · board of revision of taxes

PH8 · Iba pa

I’m yours now! ️ePhilID or electronic copy of National ID is a format that has the same functionality and validity as the physical card. In this article, you will learn the detailed steps to acquire an electronic National ID (ePhilID) on our site. Get your electronic National ID hassle-free with our comprehensive guide.

philadelphia property tax lookup*******Enter the address or 9-digit OPA property number to find and pay property taxes online. Review the tax balance chart, choose options, and agree to the terms and .Pay online through the Philadelphia Tax Center by entering your physical .

Get a property tax abatement; Get the Homestead Exemption; Apply for the .Get a Zoning Permit to change the use of a property; Get a Zoning Permit to adjust .The Office of Property Assessment (OPA) determines what every piece of property .

Get information about property ownership, value, and physical characteristics.Look up your property tax balance. Find the amount of Real Estate Tax due for a .

Here’s how to search and pay: Go to tax-services.phila.gov. Pick “Search for a property” under the “Property” panel. Enter your street address on the “Search for a property” screen .Property Inquiry. Please be sure to include any address or identifying information that might help the OPA to find the property account you are referencing. Enter the address that .AVI Calculator. You can use this application to estimate your real estate tax under the Actual Value Initiative (AVI). The Actual Value Initiative, or AVI, is a program for re .Here are some things you can do with Atlas: Find your polling place. Get the history of permits, licenses, and inspections at any address. Research real estate information . Philadelphia’s reliance on property tax revenue to fund city government is relatively low. The city received 15.4% of its general fund revenue from the tax in fiscal .The Board of Revision of Taxes (BRT) hears property assessment appeals. The Office of Property Assessment (OPA) decides the dollar-value of every piece of real estate within Philadelphia and that value determines how much property tax is owed. Owners who disagree with the OPA can file an appeal with the BRT. File a real estate market value .

philadelphia property tax lookup philadelphia brt property searchProperty tax in Philadelphia County is calculated by multiplying the taxable value with the corresponding tax rates and is an estimate of what an owner not benefiting from tax exemptions would pay. There is a .

Address. Municipal Services Building. 1401 John F. Kennedy Blvd. Philadelphia, PA 19102. Email. revenue @phila.gov. Phone: (215) 686-6600 for taxes. (215) 685-6300 for water bills. (215) 686-9200 for LOOP and Homestead.Who is submitting the Property Inquiry? Owner. Agent. Other. Name * Name is required. Email *. Valid Email Address is required Valid Email Address is required. Daytime Phone Number * Daytime Phone Number is required and should be numeric. FAX Number Fax Number should be numeric.

Get information about property ownership, value, and physical characteristics.

BEFORE YOU START. You may need the following information before you pay online: Invoice Number and Payment Number or Street Address or be a Registered User with a Username and Password. eCLIPSE Application Payment. Block Party Permit. Health Food Certificate Fee. Lobbying Registration Payment. Streets Closure Permit.

Philly311. 311 provides direct access to City government information, services, and real-time service updates. Multiple languages are available. Filing and payment methods, instructions, interest rates, and penalties related to City of Philadelphia taxes.

If you mail your request, include a self-addressed stamped envelope and a note with the address of the property. To find out the exact number of pages in advance of sending your request, contact us at (215) 686-2292 or [email protected]. Copies are $2 per page. To have a copy certified, there is an additional $2 certification fee per .

Pay with eCheck or credit/debit card. You can pay taxes by eCheck or credit/debit card on the Philadelphia Tax Center. It’s free to pay by eCheck. There is a processing fee for payments by credit/debit card. This fee is collected by the processing vendor, not by the City. There is a service fee of 2.25% for credit card payments.

Tax exemptions and abatements. Learn about abatement and exemption programs that can help you lower your real estate tax bill. The City of Philadelphia offers a number of abatement and exemption programs that may reduce a property’s real estate tax bill. Tax abatements reduce taxes by applying credits to the amount of tax due.

Overview. In fall 2021, Philadelphia taxpayers started using a new website to file and pay City taxes electronically: the Philadelphia Tax Center. This change is part of a two-phase process to replace our tax system of record. The new system will allow the Department of Revenue to provide you with better customer service.

Property may include land, buildings, mobile homes, and houses. Real Estate taxes are due once a year, on March 31st of the tax year. If the taxes are not paid by March 31st of the tax year, a penalty charge called “additions” will accrue on the principal amount of the tax up to a maximum charge of 15% of the principal amount due. To find business license information, you can use the City’s eCLIPSE business license search tool and search by business name, business location, or license number. Use the City’s Atlas tool or the L&I Property History lookup to search by address for information about: Licenses. Permits. Violations.philadelphia property tax lookup To find business license information, you can use the City’s eCLIPSE business license search tool and search by business name, business location, or license number. Use the City’s Atlas tool or the L&I Property History lookup to search by address for information about: Licenses. Permits. Violations. 1. Go to https://property.phila.gov (It says “searching by owner” has been disabled. So far, not so.) Enter your property address in the box above the map area. 2. The “Assessed Value” of your house will appear under your name. If you scroll down, you will see the valuation history, as well as a detailed description of your property. 3.

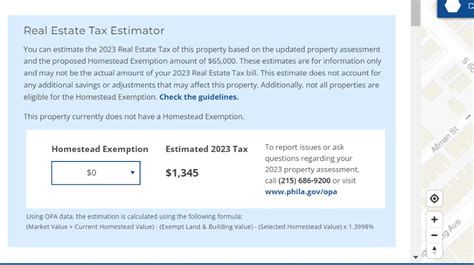

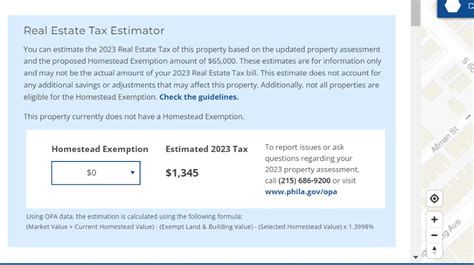

If you do not receive or misplace your FLR form, contact (215) 686-9200 to request a replacement form. Complete and submit the FLR request form by September 8, 2023. Include any additional information for the Office of Property Assessment (OPA) to consider, such as photos or recent appraisals. If the property owner wants to have someone else . Paying online – you can look up your balance and pay your bills on the Philadelphia Tax Center. The process is safe, fast, and convenient. It is also the best way to pay Philadelphia Real Estate Tax moving forward. To search and pay: Go to tax-services.phila.gov. Find “Search for a property” under the “Property” panel. The City of Philadelphia and the School District of Philadelphia both impose a tax on all real estate in the City. For the 2022 tax year, the rates are: 0.6317% (City) + 0.7681% (School District) = 1.3998% (total) The amount of Real Estate Tax you owe is determined by the value of your property, as assessed by the Office of Property .

philadelphia brt property search The City of Philadelphia recently launched an online calculator to help residents estimate their 2023 property tax bills. The Real Estate Tax estimator is available on the property.phila.gov website. It was launched soon after the Office of Property Assessment (OPA) released new assessments for over 580,000 Philly properties.. The .

Best Online Betting Sites the Philippines – Final Thoughts. MSW’s probable entry into the online betting market can only be viewed as a positive move, given that Filipino gamblers have access .

philadelphia property tax lookup|philadelphia brt property search